On my continuing quest to discover new sources of data and insight about startups, I came across a very interesting read today—and received something from TheDeets’ Ed Kohler—and wanted to share both with you.

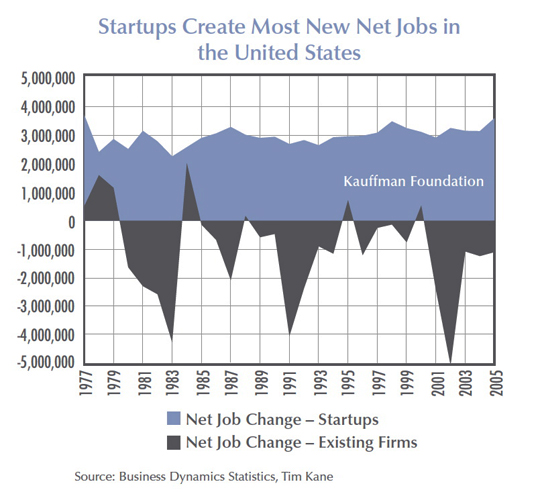

A new study (PDF) by the Kauffman Foundation paints a very different picture about the importance of startups:

When it comes to U.S. job growth, startup companies aren’t everything. They’re the only thing. It’s well understood that existing companies of all sizes constantly create – and destroy – jobs. Conventional wisdom, then, might suppose that annual net job gain is positive at these companies. A study released today by the Ewing Marion Kauffman Foundation, however, shows that this rarely is the case. In fact, net job growth occurs in the U.S. economy only through startup firms.

The Kauffman Foundation was established in the mid-1960s by the late entrepreneur and philanthropist Ewing Marion Kauffman. Based in Kansas City, Missouri, the Kauffman Foundation is among the thirty largest foundations in the United States with an asset base of approximately $2 billion.

You really need to spend some time at the Kauffman site since they have a wealth of research reports (all free) as well as this nifty Flash-based startup visualization tool.

But while it’s interesting and enlightening to see all of the efforts going on with startups around the country, the data about Minnesota was a bit disconcerting…until I thought about it for awhile.

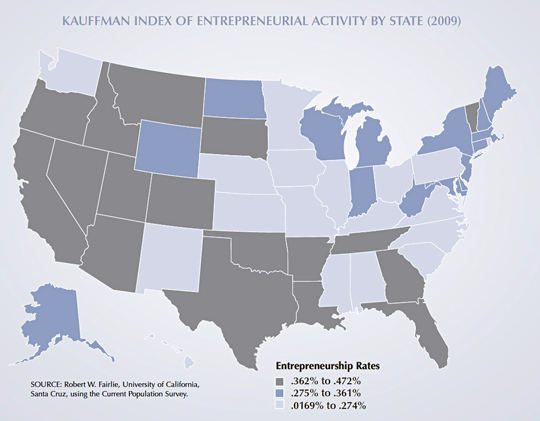

Here’s what was disconcerting as I poked through the Kauffman data: Minnesota is not ANYWHERE near the forefront of entrepreneurial activity in the nation.

The Kauffman Index of Entrepreneurial Activity by State (PDF) states that, “Entrepreneurial activity rates follow strong geographical patterns. Entrepreneurial activity generally is highest in Western and Southern states, and lowest in the Midwestern and Northeastern states. The five states with the highest entrepreneurial activity rates were Oklahoma (470 per 100,000 adults), Montana (470 per 100,000 adults), Arizona (460 per 100,000 adults), Texas (450 per 100,000 adults), and Idaho (450 per 100,000 adults). The five states with the lowest rates of entrepreneurial activity were Mississippi (170 per 100,000 adults), Nebraska (200 per 100,000 adults), Pennsylvania (200 per 100,000 adults), Alabama (210 per100,000 adults), and Minnesota (220 per 100,000 adults).”

WHY ARE THE STARTUP RATES SO LOW IN MINNESOTA?

1) Some say it was that we didn’t have incentives for investors and the Angel Tax Credit passing was key. In addition, some say there weren’t enough groups like MOJO MN, Minnesota Cup and others creating a climate of entrepreneurship in our State. I would argue that the Angel Tax Credit is a crucial (though quite recent) development and the jury is still out on it but it’s a foundational piece of kickstarting innovation in Minnesota.

2) Some say–especially as the gubernatorial race heats up—that it’s because Minnesota is such a high tax State which discourages entrepreneurial behavior. Ed Kohler, a local blogger and tech guy who does amazing writing, disagrees. Ed wrote about startups, high/low tax States, and whether or not that impacted where people started their company on his blog TheDeets. What I really appreciated was how he took another guy’s data visualization, did his own for the Twin Cities, and concluded that quality of life, smart people and the fact that startups don’t pay a lot of taxes anyway means high tax rates are a moot point in the startup debate and that Minnesota is actually a good place to start up a company.

2) Some say–especially as the gubernatorial race heats up—that it’s because Minnesota is such a high tax State which discourages entrepreneurial behavior. Ed Kohler, a local blogger and tech guy who does amazing writing, disagrees. Ed wrote about startups, high/low tax States, and whether or not that impacted where people started their company on his blog TheDeets. What I really appreciated was how he took another guy’s data visualization, did his own for the Twin Cities, and concluded that quality of life, smart people and the fact that startups don’t pay a lot of taxes anyway means high tax rates are a moot point in the startup debate and that Minnesota is actually a good place to start up a company.

3) Is it the lack of educational opportunities for startups? I’d argue no…since the Carlson School and University of St. Thomas have stellar entrepreneurial programs which have already produced many successful entrepreneurs. Add to that the sorts of coaching and professional advice winners of the Minnesota Cup receive, the lobbying and cheerleading of MOJO MN, community support from other techies here, and the ease with which startups can tap in to the brain trust that exists elsewhere because of the internet, and that doesn’t seem like a big issue.

4) Perhaps it’s the risk-averse climate? Maybe…but I’m already seeing that wane as an excuse, especially since so many local entrepreneurs are coming out with amazing technologies and leaping forward with calculated, but risky, endeavors.

IS THERE ANY GOOD NEWS?

One thing in that The Kauffman Index of Entrepreneurial Activity by State mentioned in their report was this tidbit: “From 2008 to 2009, entrepreneurial activity rates increased the most in the Midwest, but remained low in this region.”

That screams one thing to me: the Midwest has momentum. Especially in such an incredibly down economy in 2008/2009, startup levels increased (though no Minnesota-specific data was in the report comparing current levels to that particular increase).

I’d conclude that Minnesota needs to keep its foot-on-the-gas so we can reach what the author Malcolm Gladwell called the Tipping Point in his book of the same name. That tipping point is the moment that the levels at which the momentum for change becomes unstoppable.

I’d argue that we’re damn close to that tipping point right now. Look around at all the activity with Minnedemo, Minnebar, Minnesota Cup, MN High Tech Assoc, Rainmakers Conference, all the meetups and tweetups and on-and-on and you can see that the one key statement in Kauffman’s report—that “Entrepreneurial activity rates follow strong geographical patterns“—means that building the momentum in our midwestern geography (and Minnesota specifically!) is going to put us on the map but in a high per capita startup level.

I’m sure you’ll agree that the momentum for change is accelerating and feels like it’s close to becoming unstoppable. But what are the other things critical to accelerate that momentum? What will the tipping point look like and when will we know we’re at one?

Comment and let us know.