We just received this invitation to SPARK! Annual Celebration of Innovation and thought we’d pass it along. It will be held at the Muse Event Center on January 22nd.

Minnov8 Gang 247 – NSA: Hacking iPhones from the Beginning

The Gang discusses the top stories of the past week including the National Security Agency (NSA) having a nearly complete “backdoor” to the iPhone!

The Gang discusses the top stories of the past week including the National Security Agency (NSA) having a nearly complete “backdoor” to the iPhone!

Hosts: Steve Borsch, Tim Elliott and Phil Wilson (Graeme Thickins is off).

Music: Wings of Sunshine Artist: Marius Kahan. Brought to us by Music Alley.

![]()

The Podcast

Podcast: Download (Duration: 1:02:49 — 36.5MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- Target’s Troubles Continue:

- Dan Carr, champion of innovation, is leaving The Collaborative

- Holiday retail winners and losers

- Best Buy launches Life & Tech magazine

- Transition for the Nerdery complicated by history

- MN Cos. Show Off Tech At Consumer Electronics Show (CES)

Other Stories

- The NSA has nearly complete backdoor access to Apple’s iPhone

- Scoble says Google Glass is doomed

- Kara Swisher and Walt Mossberg launch ‘Re/code’

- Quartz: 2013 was a lost year for tech

- Dayton letter blasts IBM for MNsure website failings

- The $38 Android Tablet Is Coming to the U.S.

- IKEA Hackers

Check out this story: It’s Been Out of This World Cold in

Northern Minnesota Lately – Colder Than the Surface of Mars

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- MHTA Event at Mpls Institute of Arts – Jan 9, 2014

- Beta.MN inaugural event, January 30th (tickets available at 7:00 am on Jan 6th)

- Minneapolis Public Schools STEM Expo – Tuesday, Feb 12, 2014

- Mobile March March 20, 2014 – Tickets on sale now!

Minnov8 Gang 246 – Predicting 2014

The Gang does its annual technology prognostications for 2014. Hear what we predicted to happen in 2013 (and what we missed) and listen to our prognostications for 2014.

Hosts: Steve Borsch, Tim Elliott, Graeme Thickins and Phil Wilson.

![]()

The Podcast

Podcast: Download (Duration: 58:35 — 34.3MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- Target

- With Shoppable Hangout, Best Buy marries social media to commerce

- Plowz brings a plow to your driveway via a phone app

Other Big Stories

- Amazon sold 426 items per second in run-up to Christmas

- There yet? UPS, FedEx moving Christmas packages late

- Apple’s iOS Completely Blew Away Google’s Android For Shopping On Christmas

- Google Chromebooks Find Success Over the Holidays

2013 Predictions Links

2013 Predictions Links

2014 Predictions Links

- The Erasable Internet

- Apple Hearing Aid iPhone

- ReSound

- Bitcoin

- Internet of Things

- U.S. Power Grid

- Bluetooth Smart (also called Bluetooth LE or Bluetooth 4.0)

- Wearable Technology

- Personal Cloud

- Big Data tools

- NSA/Future of Encryption

![]()

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- MHTA Event at Mpls Institute of Arts – Jan 9, 2014

- Minneapolis Public Schools STEM Expo – Tuesday, Feb 12, 2014

- Mobile March March 20, 2014 – Tickets on sale now!

Minneapolis Public Schools STEM Expo

Always an incredibly worthwhile event, the STEM Expo Project Coordinators, Lisa Gray & Sara Etzel, reached out to Minnov8 regarding the upcoming expo.

Always an incredibly worthwhile event, the STEM Expo Project Coordinators, Lisa Gray & Sara Etzel, reached out to Minnov8 regarding the upcoming expo.

Sara let us know that, “As of today there are approx. 2,400 Minneapolis Public School 6th grade students registered to attend the Expo in February…a 300% growth since our first STEM Expo back in 2011. As a district we are very excited to have our students make connections between their academics, career potential, and the STEM-related opportunities that abound around the metro.” Pretty impressive participation!

Rather than write everything up for you they were kind enough to provide us with the release below which will detail the event in total. Please consider participating in one of these three ways:

- Reserve exhibit space to promote STEM careers/activities related to my organization

- Become a formal STEM Expo sponsor and receive preferred exhibit location and publish your logo on marketing materials

- Donate a prize(s) for student participation raffle.

Here is the STEM Expo Registration with all of those three options and more items. If you have any questions, please contact Sara Etzel at 651-334-4529 or send her an email.

![]()

3rd Annual Minneapolis Public Schools STEM Expo – February 12, 2014

3rd Annual Minneapolis Public Schools STEM Expo – February 12, 2014

Background Info: For the past two years Minneapolis Public Schools has co-hosted a STEM Expo for 3,000+ middle school students from across the district to promote the importance of academic achievement and the value of rigorous courses that highlight math and science.

When: Tuesday, February 12, 2014 – 8:00 to 4:00pm

Where: Minneapolis Convention Center – Exhibit Hall E (over 100,000 square feet of exhibit space!)

What: The 2014 STEM Expo is going to be a great day of STEM exploration for ALL 6th grade students from across the district. Students will dive deep into STEM-based careers and related extra-curricular activities in our schools and the community. The Expo will include hands-on, interactive STEM activities sponsored by local businesses, community partners, and post-secondary institutions to increase student interest in STEM-related careers opportunities across Minnesota. Plus, special guest appearances by local VIPs.

“Tools of the Trade” exhibits … will highlight the awesome equipment used by STEM professionals every day! STEM pathways represented will include: agriculture and agri-business, computer and information technology, manufacturing, engineering, bio-medical and healthcare, and environmental and life sciences. Business professionals and university students will display and provide short demonstrations related to their STEM-related careers, the realistic steps and obstacles in pursuing STEM-related careers, and all the amazing aspects of their jobs

Pathway community exhibits … The Twin Cities is the “high tech” capital of the Midwest and with that comes amazing local after-school and community STEM activities. Our STEM Pathway exhibits will highlight how STEM is present in the many co-curricular opportunities available to Minneapolis Public School students, including post-secondary college and career readiness options.

“Physics Force” Main Stage Performance … bowling balls, implosions, fire extinguishers, marshmallows and human rockets —they’re all part of a unique and fun University of Minnesota Tate Laboratory of Physics outreach program that aims to entertain and educate students of all ages about the laws of physics through a series of action-filled demonstrations related to air pressure, waves & sound, Bernoulli effect, projectile motion, collisions, and inertia.

STEM Passport … Students will have their “STEM passport” stamped as they participate and engage in meaningful conversations with exhibitors. Completion of the passport and survey will qualify students to win donated prizes.

Past Exhibitors & sponsors have included:

3M Travelling Wizards, AchieveMpls* – WBL, Advance IT Minnesota, BDPA Twin Cities, Bell Museum – Exploradome, Bitwixt Software Systems, Boston Scientific*, Cargill*, CenturyLink*, CFANS – U of MN, Children’s Hospital, Community Renewal Through Innovative Building – CRIB. Dakota County Technical College*, Dunwoody College, FIRST Robotics, Haldeman – Holme, Herobotics- Henry High School, High Tech Kids, Inver Hills Community College, KidWind Project, MCTC, Microsoft, Minneapolis Convention Center*, Minneapolis Public Schools*, Minnesota Department of Transportation, Minnesota High Tech Association*, Mobile Apps, Morning Earth.org, ACE Mentoring, MPLS – JATC Electrical, MPLS – JATC Floorcoverers, Normandale Community College, Omnitool, PCL Construction*, PQI, Rêve Academy, Science

Minnov8 Gang 245 – Let’s Pay With…Dimes!

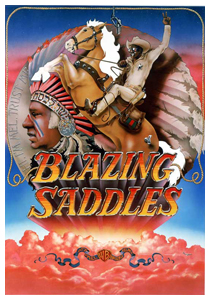

The biggest story this week was the Target holiday cyber breach hits 40 million payment cards. We jokingly said we should—like in the movie Blazing Saddles where Slim Picken’s character encounters a toll booth in the middle of the desert and, rather than go around it, exclaims to his posse that “Somebody’s got to go back and get a sh*tload of dimes!” (at youtube)—start paying our checkout amount at Target with bags of dimes.

The biggest story this week was the Target holiday cyber breach hits 40 million payment cards. We jokingly said we should—like in the movie Blazing Saddles where Slim Picken’s character encounters a toll booth in the middle of the desert and, rather than go around it, exclaims to his posse that “Somebody’s got to go back and get a sh*tload of dimes!” (at youtube)—start paying our checkout amount at Target with bags of dimes.

Hosts: Steve Borsch, Tim Elliott, Graeme Thickins and Phil Wilson.

Music: Ruth’s Boogie Artist: Jake Lear. Brought to us by Music Alley.

![]()

The Podcast

Podcast: Download (Duration: 1:02:29 — 36.3MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- Target Breach

- Dec 13th story broken by Brian Krebs: Target Investigating Data Breach

- Advice for leery Target customers from creditcards.com

- Target security breach: Questions and answers

- Target CEO offers credit monitoring, discount and four-part video apology for data breach

- One estimate: Cost of Target data breach could hit $680 million

- Stolen Target Credit Cards Are Selling For $20 – $100 Each

- Target’s Biggest PR Mistake With Credit Card Security Breach

- Check your Credit

- Apple’s Mac Pro Debuts

- Best Buy: 2013’s top retail stories: Best Buy bounces back

- QFOLabs: Toy copter that bombed on Kickstarter now on Brookstone

Other Stories

Steve’s Security Tip of the Week

- Use Extreme Caution With Your Debit Card (this is a detailed post here on Minnov8)

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- MHTA Event at Mpls Institute of Arts – Jan 9, 2014

- Minneapolis Public Schools STEM Expo – Tuesday, Feb 12, 2014

- Mobile March March 20, 2014 – Tickets on sale now!

Steve’s Security Tip of the Week – Use Extreme Caution With Your Debit Card

On December 13, 2013 the security researcher, Brian Krebs, broke a story on his blog which turned in to an admission by Target that they had experienced a 40 million credit and debit card security breach which occurred from Black Friday through December 15th.

On December 13, 2013 the security researcher, Brian Krebs, broke a story on his blog which turned in to an admission by Target that they had experienced a 40 million credit and debit card security breach which occurred from Black Friday through December 15th.

(Update from Krebs 12/20/13: Cards Stolen in Target Breach Flood Underground Markets)

In a KARE11/USA Today article released just after lunch today, apparently there is “no indication” that debit card personal information numbers (PIN) were part of the breach:

Stolen information from some 40 million credit and debit cards used in its stores from Black Friday through Dec. 15 included names, credit or debit card numbers, card expiration dates and the CVV data on the magnetic stripe on cards, the retailer said.

Target spokesman Eric Hausman confirmed, however, it has “no indication that debit card PINs were impacted.”

Target’s own credit card data, REDcard, was breached but so were all bank credit or debit cards used by shoppers. The big red flag for my family and me in early news reports was the realization that we almost exclusively use debit cards for our retail purchases. Though ours are backed by Visa and Wells Fargo policies (which dramatically limit our exposure) as you’ll see the personal risk and liability for using a debit card over a credit card is MUCH higher!

Though little is known about the exact nature of the Target breach as I write this post, Target’s statement about there being “no indication” that PIN numbers weren’t breached is weak assurance that we Target-shopper’s debit card PIN numbers were not stolen. Some commentary I’ve read suspect code was inserted in to the Target network and the crooks were able to intercept the data on the magnetic strip when shoppers used their cards at a Target point-of-sale (POS) terminal. Capturing this information would then enable crooks to place that data on a counterfeit card or use it for online shopping (Update: As Krebs points out in the last paragraph of his updated post, there are two CVV numbers: one on the magnetic strip and one printed on the back of the card itself. Online retailers use the “CVV2” printed number to verify that you are, in fact, most likely holding the card in your hand. Target has confirmed that the CVV1′s were stolen but the CVV2s were not).

“No indication” of a PIN breach or not, the big problem for we debit card users is that our PIN numbers could have been intercepted from that same POS terminal thus enabling thieves to use it for direct purchases or even ATM withdrawals, according to Krebs:

The type of data stolen — also known as “track data” — allows crooks to create counterfeit cards by encoding the information onto any card with a magnetic stripe. If the thieves also were able to intercept PIN data for debit transactions, they would theoretically be able to reproduce stolen debit cards and use them to withdraw cash from ATMs.

ABOUT DEBIT CARDS

Most of us know that it is simple to report fraud on a credit card, have your card reissued, and at most we’re at risk for $50 if we report it within 60 days. What most people do NOT know is that using a debit card could cause your bank account to be drained and end up with you needing to fight, potentially for months, to get your money returned in to your account.

Most of us know that it is simple to report fraud on a credit card, have your card reissued, and at most we’re at risk for $50 if we report it within 60 days. What most people do NOT know is that using a debit card could cause your bank account to be drained and end up with you needing to fight, potentially for months, to get your money returned in to your account.

Did you also know there are two types of debit cards? I didn’t and it turns out our debit cards from Wells Fargo can be used as either a credit or debit card (i.e., used with or without a PIN).

In February of this year ABC News had a good article on Why Using Debit Cards Can Be Dangerous which had these two key paragraphs that detailed the difference (my emphasis):

Unbeknownst to most people there are actually two different types of debit cards, deferred and direct. The deferred card – or signature-based – is similar to a credit card minus the credit. This card requires you to sign for the purchase and then the money will be debited from your checking account within two to three days. A direct – or PIN-based – debit card requires that you punch in your PIN number every time you buy something and the money is immediately withdrawn from your account.

When the consumer uses their personal identification number to make a purchase, the retailer usually pays a flat fee to the bank. However, when the purchaser opts to use their debit card as a credit card, which typically requires a signature, the retailer generally has to pay a percentage fee based on the amount of your purchase. Therefore, it is becoming more common for the retailers to encourage PIN-based transactions, and several are no longer accepting debit card purchases that require a signature at all.

Retailers pay billions in fees to credit card companies that back debit cards so they have a huge incentive to get us to use the direct (PIN-based) method at the register.

I stopped and thought about my own family’s debit card use and that many retailers we frequent do ask for a PIN to be entered in the terminal. Sometimes it is obvious how you can bypass this (so the retailer pays that fee and our PIN isn’t exposed), but sometimes it is not. Frankly I never paid much attention to it since I shop at reputable retailers (like, um, Target?) but I will in the future.

HOW TO PROTECT YOURSELF

Should you just cut up your debit card and exclusively use a credit card going forward? Probably if you consider this example of what happens if your debit card is breached and used fraudulently. An implied warning was laid out well in this BankRate.com article about why using a debit card is fraught with peril and risk (my emphasis):

Debit cards are different. Debit cards may look identical to credit cards, but there’s one key difference. With credit cards, users who spot fraudulent charges on their bill can simply decline the charges and not pay the bill. On the other hand, debit cards draw money directly from your checking account, rather than from an intermediary such as a credit card company.

Because of that, even clear-cut cases of fraud where victims are protected from liability by consumer protection laws can cause significant hardship, says Frank Abagnale, a secure-document consultant in Washington, D.C.

He cites the example of the The TJX Companies Inc.’s T.J. Maxx data breach that exposed the payment information of thousands of customers in 2007. The incident resulted in $150 million in fraud losses, and much of it was pulled directly from customers’ bank accounts. While credit card users got their accounts straightened out and new cards in the mail within a few days, the case created major problems for debit card holders who waited an average of two to three months to get reimbursed, Abagnale says.

If you are going to use, or have to use, a debit card, BankRate also provided four transaction points where you should use extreme caution (or never, ever use) a debit card. NOTE: I added #5 since we travel frequently on business and #6 because of my own personal investigation with our bank:

1) Independent ATMs – You run the risk of skimmers. While skimmers can be found on bank ATMs, they’re less likely because there are often security cameras in place.

1) Independent ATMs – You run the risk of skimmers. While skimmers can be found on bank ATMs, they’re less likely because there are often security cameras in place.

2) Pay at the pump – Skimmers aren’t the only danger to your wallet. The gas station will put a big hold on your account that could cause your checks to bounce. If you must pay with debit at gas station, go inside and pay at the cashier.

3) When you’re buying online – Credit card is a much better option. If you don’t get your merchandise, you can do a chargeback during a 60-day window. Debit card amounts are immediately withdrawn from your account and you have to fight the merchant (and quite often your bank) to get your money back.

If it is a small or unknown merchant (e.g., on eBay or an Amazon affiliated merchant) good luck getting reimbursed. If someone has fraudulently used your credit card, you (or your credit card company) are likely to spot it before you get the statement. That means you are never out the money. You dispute the charge, subtract the disputed amount from your bill and let the credit card issuer worry about it. With a debit card, the stolen money may have already left your account. That means you have to dicker with your bank to get reimbursed. Some banks are quick and helpful in resolving these disputes. Others? Not so much.

4) At a restaurant – Because there is such high turnover of wait staff at restaurants, you don’t want a dishonest employee to get hold of your debit card or, hopefully, not run it through a pocket-sized credit card data skimmer (which stores your track data which can subsequently be used to counterfeit your card).

5) When traveling – Consider very seriously never using your debit card while traveling and specifically for booking and paying for your hotel or rental car. When using a debit card hotels and rental car companies place a “hold” on money in your account to ensure that you have sufficient funds to pay your bill when you check out. This held amount can typically be for double the amount of your stay (in case you stay longer or raid the minibar at the hotel) or some arbitrary amount in the thousands of dollars in the case of a rental car company (in case you damage the vehicle). Add to that the unknown number of merchants with which you will interact while traveling (and this varies by country, of course) and your risk could rise exponentially.

6) Discover your bank’s debit card policies – One would think our bank, Wells Fargo (which is the 4th largest in the U.S.) would clearly spell out their debit card policies and how they protect us, right? Nope. It was startlingly obtuse and caused me to dig around alot…and I still didn’t get all my questions answered.

6) Discover your bank’s debit card policies – One would think our bank, Wells Fargo (which is the 4th largest in the U.S.) would clearly spell out their debit card policies and how they protect us, right? Nope. It was startlingly obtuse and caused me to dig around alot…and I still didn’t get all my questions answered.

Calling Wells Fargo customer debit card support on Friday morning to replace my wife and my debit cards (just in case they were breached at Target) was a lengthy but easy process, the hard part was trying to find out what our bank’s policy was about when fraud should be reported. Some online articles say things like “most banks want you to report within two days” and others say “within 60 days“. Does prompt mean two days? 30 days? 60 days?

Logging in to our Wells Fargo account I was partially relieved to discover that, even though the bank still doesn’t define “promptly”, it does have some good information about how we are protected:

Your Wells Fargo Debit Card comes with Zero Liability protection at no extra cost:

+ You won’t be liable for promptly reported unauthorized purchases or ATM transactions.

+ 24/7 monitoring: we help prevent unauthorized transactions by regularly reviewing your accounts for unusual activity.

+ Expert help is just a phone call away if your financial information is compromised or stolen. We’ll provide the information and assistance to help you get your account back on track.

+ Get real-time access to all transactions and balances to stay informed of all account activity. Your account information will not be shared with non-affiliated third-party marketers without your consent.

+ Alerts: When you sign up for ATM/debit card alerts, it’s easy to stay informed about unusual activity on your Wells Fargo card. You can set up alerts for any of the following types of activity that may occur:Your purchase or ATM withdrawal is made from an international location.

– Your card is used to make a purchase over the internet, by phone, or by mail order.

– Your purchases exceed an amount designated by you.

– Your daily ATM withdrawals exceed an amount designated by you.

What does your debit card issuing bank offer? I would heartily recommend that, if you have a debit card and use it, you find out what your bank does for you if it is lost, stolen or its data compromised and the card used fraudently. Also find out if they offer alerts like Wells Fargo does (which I’ve now set up on all cards) since it can quickly notify you of any aberrations with your debit card usage.

WILL THERE SOON BE HIGHER FEES FOR USING A DEBIT CARD?

Here is one last data point for your consideration about whether or not to consider using a debit card as you shop going forward: debit cards carry higher risks for everyone so fees are likely to go up.

Here is one last data point for your consideration about whether or not to consider using a debit card as you shop going forward: debit cards carry higher risks for everyone so fees are likely to go up.

In the 2013 LexisNexis® True Cost of Fraud Study (PDF) it is pretty clear to me that we shoppers using debit cards simply cost retailers and financial institutions too much money (my emphasis):

Nearly all of the FI interviewed (financial institution executives surveyed) report that credit and debit cards continue to represent both the highest volume of fraud among their product lines and their greatest area of exposure. Some attributed 30%-40% of their overall fraud losses to fraud associated with their credit card and debit card products. Among the types of issues that they are experiencing at the POS, skimming and counterfeit cards continue to be a major problem. Card-Not-Present fraud is on the rise, and as consumers continue to use online and mobile retail channels, issuers are faced with potential for growing fraud exposure.

Visa’s™ April 19th, 2013 chargeback rule change is negatively impacting the success rates of chargebacks among some issuers. By only requiring that merchants provide evidence that the card in question was presented to the cashier, issuers are losing what may have previously been successful chargebacks. They are experiencing a rise in debit card charge backs, particularly through online channels, with charge back recovery rates of about 70% to 85% for most card products. However, many issuers reported lower success rates with debit cards compared to that of credit cards.

Bottom line? We debit card-using shoppers cost retailers more if we don’t use our PIN numbers, fraud perpetrated with debit cards (and disputed charges causing chargebacks) are higher and that costs card-issuers more, and that the card-issuing companies are less successful recovering incorrectly disputed chargebacks so that costs them more too. The only likely outcome of this is higher fees for using debit cards.

Good luck and happy shopping!

![]()

FURTHER READING

Minnov8 Gang 244 – Hey Rocky!

Too often in the technology game it feels like Bullwinkle’s attempt to amaze Rocky with his feat of magic: Instead of a rabbit being pulled out of his hat something else pops out! On this week’s show we discuss company pivots, crowdfunding projects postponed, an ‘affordable’ knock off of a brand name and more.

Hosts: Steve Borsch, Tim Elliott and Graeme Thickins (Phil Wilson is off)

Music: Too Late To Try To Do Right Artist: Root Doctor. Brought to us by Music Alley.

![]()

The Podcast

Podcast: Download (Duration: 1:08:00 — 39.7MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- SMBMSP: How You Can Begin Doing the Work of Your Dreams

- New initiative from CoCo MSP: CoCo Jump School

- A WordPress plugin converts (Google) Glass into a blogging tool

- NativeX partners with SEGA for expansion of mobile ad network

- Network Instruments of Minnetonka to be acquired for $200 million

- The Nerdery Names New President

- “Dell exec: We’re ‘fine-tuning’ our cloud strategy”…and the acquisition of MN’s Enstratius is playing a key role

- Kickstarter Project Postponed Despite $41K In Pledges

- Study: Minnesota 3rd In Nation Among Kickstarter Users For Tech Financing

- Retail

Other Stories

- Apple’s iBeacon

- Why Nokia Is Building an Android Phone and Why Microsoft Might Not Kill It

- No, Gmail’s tweak won’t stop e-mail marketers from knowing if you open their e-mail

Steve’s Security Tip of the Week

- ATM Credit/Debit Card Skimmers

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- TIES 2013 Education Technology Conference, December 14-17

- Mobile Tech Meetup Happy Hour Monday, December 16, 5-7pm

- MNSearch Holiday Social Wednesday, December 18, 6-9pm

- Mobile March March 20, 2014 – Tickets on sale now!

Minnov8 Gang 243 – Stars Wars? Never Heard of It

Hosts: Steve Borsch, Tim Elliott and Phil Wilson (Graeme Thickins is off)

Music: Hill Billy Idol Artist: Texarillo. Brought to us by Music Alley.

![]()

The Podcast

Podcast (m8-audio): Download (Duration: 55:23 — 44.9MB)

Subscribe: RSS

Podcast: Download (Duration: 55:23 — 32.6MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- New Site, App, & Experience from @SmartThings

- Target & Pinterest

- Julio Ojeda-Zapata on WCCO Sunday morning show with holiday gift ideas

Other Stories

- Mobile Commerce on Black Friday/Cyber Monday

- Amazon unveils futuristic plan: Delivery by drone

- Apple

- Apple’s iBeacon location-aware shopping goes live today

- Now in Apple Stores: iBeacon Location-Tracking Technology

- Apple Buys Topsy For Price Reportedly North Of $200M, Could Use Social Signals To Bolster Siri, App Store Relevance

- Apple’s ‘smart dock’ would give Siri a permanent place in the home

- iPad Air Wins Black Friday-Cyber Monday: New Devices Increase by 51%

- iOS and Android Adoption

- Snowden and Greenwald: The Men Who Leaked the Secrets

- Ron Burgundy Anchors Bismarck ND Newcast

- Who was Stuart Smalley?

Steve’s Security Tip of the Week:

Here’s A Great Idea For Creating Passwords That Are Easy To Remember But Hard To Hack

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- TIES 2013 Education Technology Conference, December 14-17

- Mobile March March 20, 2014 – Tickets on sale now!

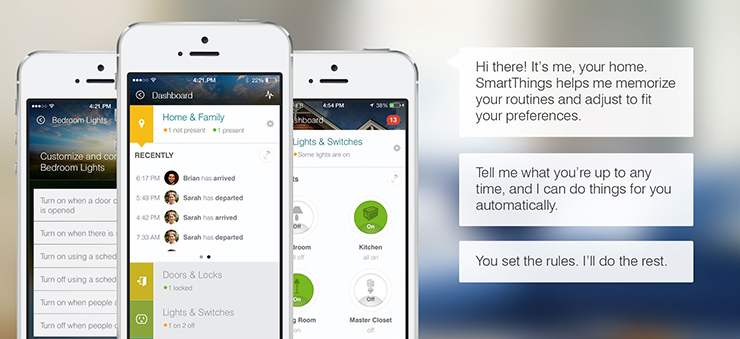

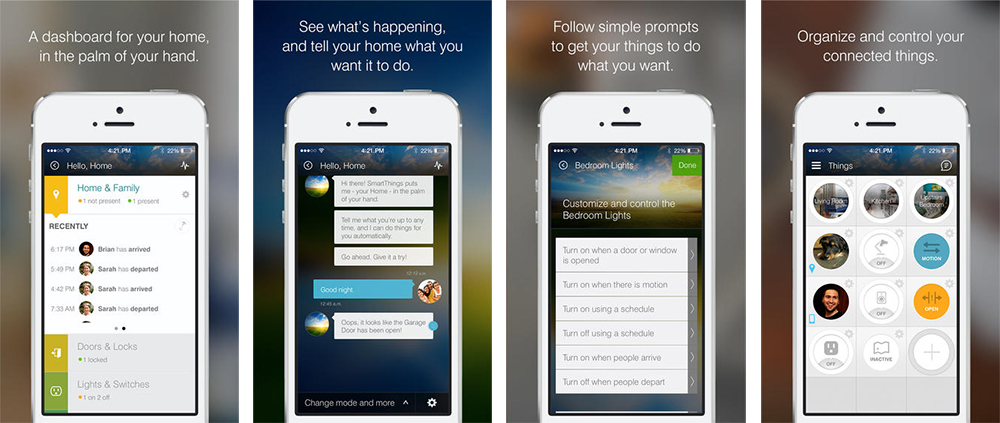

SmartThings’ New Clean & Slick App

Making certain it is simple to setup and configure ‘things’ that connect to a SmartThings hub, the company yesterday rolled our their new iOS 7 application (iTunes app store link). They also made certain to alert their Android customers that one is coming for that platform as well within weeks.

While the previous app worked well—especially after an update a few weeks ago that squashed a few bugs—this new version hits the sweet-spot for taking SmartThings to the next level with the average consumer.

It is significantly easier to use and much more logical and intuitive than the old layout. While the ‘old’ access to things and apps remains, the new layout provides several higher level functions:

Dashboard

Laid out in a very clean and straightforward way, all one’s things in the home can be grouped in Home & Family, Doors & Locks, Lights & Switches, and Danger & Damages (and coming soon: Motion & Cameras and Comfort).

Hello, Home

This functionality lets you customize your home to react to your unique daily patterns, and also tell it what you’re up to so it can adapt when your plans and routines change.

Activity Feed

While one could poke around previously to discover the log stream of activity, now it is simple to view what is happening with all of your connected things: When the go on and off; which thing triggered another thing; and so on.

Screenshots from the new iOS 7 SmartThings app (iTunes app store link)

Another significant development, and one I’ve not yet read anywhere, is that SmartThings is in distribution and not just selling everything themselves at the SmartThings Shop. While searching for z-wave compatible items at Amazon the other day, I suddenly noticed quite a number of SmartThings items appearing like this one. This is a good move by the company and, in two conversations I’ve had with home audio/video/alarm installers I know in the past month, both are looking at home automation and the Internet of Things very seriously. All of this bodes well for SmartThings going forward.

Great app that has made using SmartThings significantly more enjoyable since yesterday and the bonus? Two newbies in my family understand how to use it with NO COACHING by me!

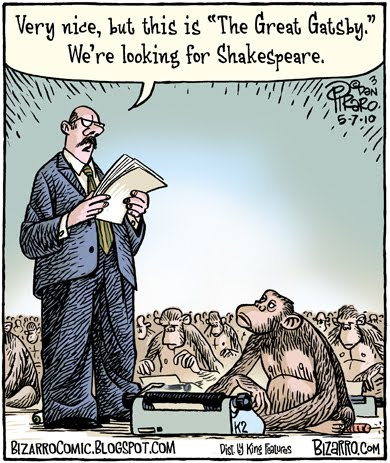

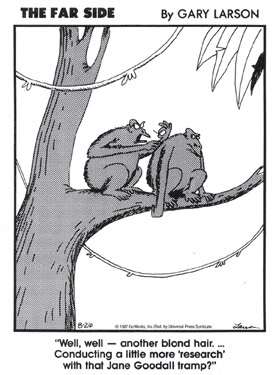

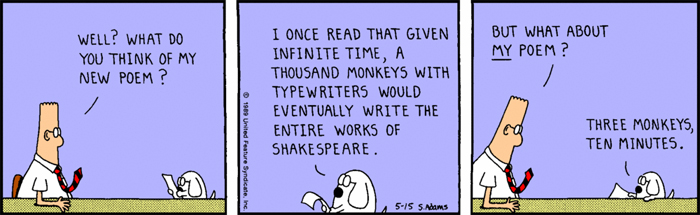

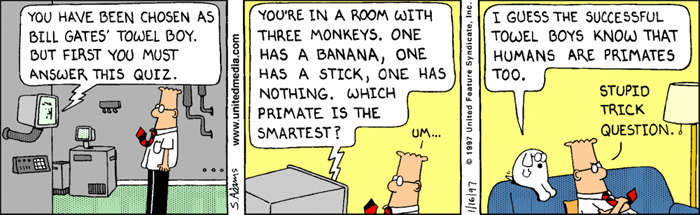

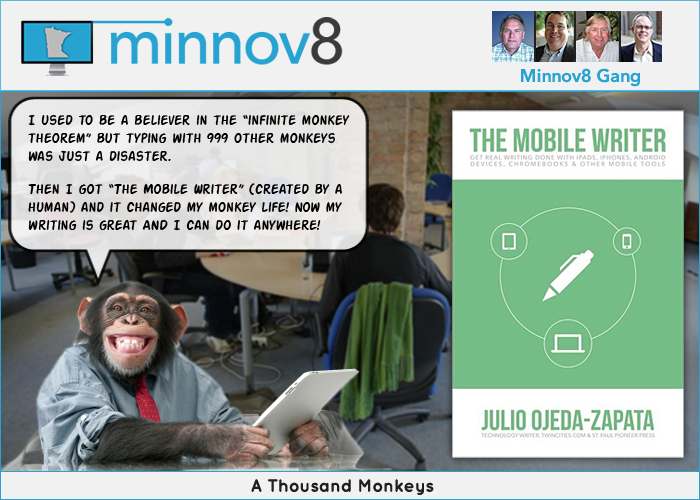

Minnov8 Gang 242 – A Thousand Monkeys

The infinite monkey theorem states that a monkey hitting keys at random on a typewriter keyboard for an infinite amount of time will almost surely type a given text, such as the complete works of William Shakespeare. What if there were a thousand monkeys? Could they create a book on mobile writing? Or would it take a seasoned technology writer to create one called The Mobile Writer and make it available for sale for $2.99?

The infinite monkey theorem states that a monkey hitting keys at random on a typewriter keyboard for an infinite amount of time will almost surely type a given text, such as the complete works of William Shakespeare. What if there were a thousand monkeys? Could they create a book on mobile writing? Or would it take a seasoned technology writer to create one called The Mobile Writer and make it available for sale for $2.99?

Hosts: Steve Borsch, Tim Elliott, Graeme Thickins, Phil Wilson and Julio Ojeda-Zapata.

Music: Wine, Woman and Song Artist: Johnny Ferrerira. Brought to us by Music Alley.

![]()

The Podcast

Podcast: Download (Duration: 1:00:59 — 35.6MB)

Subscribe: Apple Podcasts | RSS | More

![]()

Discussed During the Show

Minnesota Stories

- Report: New Biz Expansions To Bring 1,500 MN Jobs

- New “Upscale” Co-working Space To Open In Edina

- Twin Cities-area Google Glass ‘Explorers’ tell their stories

- New book by Twin Cities tech journalist, Julio Ojeda-Zapata, called “The Mobile Writer” available here for only $2.99

Other Stories

Upcoming Events

- INVESTyR’s Fundraising in the Digital Economy 1st Tue of each month 3:30-4:30pm

- TiE MN Chapter event: The Future for Crowdfunding and Raising Capital, Tues, Dec 3rd

- Connect Minnesota Summit: The State of Broadband on Wed, Dec 4th

- TIES 2013 Education Technology Conference, December 14-17

![]()

Monkey Related News